Wish you a blessed Christmas & happy New Year!

Unabhängiger Blog über interessante Rohstoff-Stories, spannende Wirtschafts-, Politik- und Finanzthemen, das BIG PICTURE, den Kapitalmarkt, aussichtsreiche Investments, aktuelle und brisante Themen + Trends aus der Rohstoff-, Minen- und Energiebranche, sowie über sämtliche Faktoren, die auf den spannenden Rohstoff-Markt Einfluss nehmen. "The more I learn, the more I realize how much I don‘t know." (A.E.) | Always Do Your Own Due Diligence.

Donnerstag, 22. Dezember 2016

Freitag, 16. Dezember 2016

US-Aktienmarkt: Wertvollste Unternehmen nach Marktkapitalisierung (2006-2016 YTD)

Die großen US-Techkonzerne haben die Spitzenplätze in den letzten Jahren fest eingenommen. Der weltgrößte Ölkonzern der westlichen Welt wird währenddessen nach unten durchgereicht:

Quelle: pensionpartners.com

Labels:

Aktien,

Apple,

Berkshire Hathaway,

Bewertungen,

Börsenwert,

Dow Jones,

ExxonMobil,

Google,

Marktkapitalisierung,

Microsoft,

Nasdaq,

S&P 500,

Technologiewerte,

USA

Donnerstag, 15. Dezember 2016

Nuklearenergie: Japan startet weiteren Atomreaktor - Uranpreis zieht an

Hierzu ein aktueller Beitrag von Fission Uranium's (T.FCU) CEO Dev Randhawa:

The Pace of Japanese Restarts

Just about every month we get positive news coming out of China regarding their nuclear sector – completed reactors coming online, new construction beginning. In the same way that we’ve become used to the world’s second-largest economy powering ahead with its reactor construction boom, we’ve also become used to Japan hemorrhaging money and pumping out fossil fuel emissions with so many of its reactors still offline.

It was therefore a pleasure to read, a few days ago, that Japan’s Kyushu Electric Power Co. had restarted a nuclear reactor in the Kagoshima prefecture after the governor, who is opposed to nuclear power, admitted to the prefectural assembly that he had no legal power to prevent the restart..

Link: http://www.fissionuranium.com/blog/index.php?&content_id=552

The Pace of Japanese Restarts

Just about every month we get positive news coming out of China regarding their nuclear sector – completed reactors coming online, new construction beginning. In the same way that we’ve become used to the world’s second-largest economy powering ahead with its reactor construction boom, we’ve also become used to Japan hemorrhaging money and pumping out fossil fuel emissions with so many of its reactors still offline.

It was therefore a pleasure to read, a few days ago, that Japan’s Kyushu Electric Power Co. had restarted a nuclear reactor in the Kagoshima prefecture after the governor, who is opposed to nuclear power, admitted to the prefectural assembly that he had no legal power to prevent the restart..

Link: http://www.fissionuranium.com/blog/index.php?&content_id=552

Quelle: palisaderadio.com

Nach FED-Entscheidung: Chaos am Devisen- und Anleihe-Markt

Der Yen und Euro befinden sich zum US-Dollar nach der FED-Entscheidung im freien Fall. Hierzu ein aktueller Bericht auf Zerohedge:

Dollar Surges, Yields Soar, Euro Tumbles To 13 Year Low As Markets React To Hawkish Fed

This morning the world awakes to a landscape in which markets are frantically rushing to catch up to a suddenly hawkish Fed which not only hiked for the second time in a decade but, as per yesterday's Fed statement and Yellen press conference, realized it has been behind the curve all along, and the result has been a spike in the dollar across virtually all currency pairs with the USDJPY surging above 118.40, coupled with a jump in bond yields around the globe as bond (the US 10 Year is trading at 2.64%, the highest since September 2014) as traders dump any hint of duration..

Dollar Surges, Yields Soar, Euro Tumbles To 13 Year Low As Markets React To Hawkish Fed

This morning the world awakes to a landscape in which markets are frantically rushing to catch up to a suddenly hawkish Fed which not only hiked for the second time in a decade but, as per yesterday's Fed statement and Yellen press conference, realized it has been behind the curve all along, and the result has been a spike in the dollar across virtually all currency pairs with the USDJPY surging above 118.40, coupled with a jump in bond yields around the globe as bond (the US 10 Year is trading at 2.64%, the highest since September 2014) as traders dump any hint of duration..

Mittwoch, 14. Dezember 2016

Interview mit Fondsmanager und Branchenexperte Warren Irwin über die großen Chancen Uran-Markt

Spannende Einblicke vom versierten Portfolio-Manager Warren Irwin bei Rosseau Asset Management - credit to Palisade Radio:

Quote:

Warren Irwin: A Rip-Your-Face-Off Uranium Rally Begins!

Quote:

Warren Irwin: A Rip-Your-Face-Off Uranium Rally Begins!

POSTED ON DECEMBER 12, 2016 BY COLLIN KETTELL

There’s been a lot of action in uranium the last few months- especially post US elections. Trump and team are positive on uranium, and the US is the biggest consumer of uranium in the world. Uranium Participation Corp- a proxy for the spot price of uranium, began trading at a premium just two weeks ago, which typically happens when bullish sentiment enters the market. On December 6th, we put out a call that the stocks had bottomed. Spot uranium has since moved up for the first time in several months..

There’s been a lot of action in uranium the last few months- especially post US elections. Trump and team are positive on uranium, and the US is the biggest consumer of uranium in the world. Uranium Participation Corp- a proxy for the spot price of uranium, began trading at a premium just two weeks ago, which typically happens when bullish sentiment enters the market. On December 6th, we put out a call that the stocks had bottomed. Spot uranium has since moved up for the first time in several months..

Labels:

Athabasca Basin,

Cameco,

Energy Fuels,

Fission Uranium,

Fondsmanager,

Interview,

Junior-Mining,

Kazatomprom,

Nexgen Energy,

Nuklearenergie,

Trump,

Uran,

Uranaktien,

Uranium Energy,

Warren Irwin

Gold: Indische Importe ziehen wieder kräftig an

Die indischen Gold-Importe markieren im Zuge des Chaos um die kontroverse Währungsreform im November ein neues Jahreshoch. Zwar liegt das totale Import-Volumen in 2016 weit unter dem Vorjahresniveau, doch die physische Nachfrage der traditionellen Goldnation bleibt solide.

Quelle: bloomberg.com

Dienstag, 13. Dezember 2016

Montag, 12. Dezember 2016

Sonntag, 11. Dezember 2016

Dow Jones, S&P 500, Nasdaq 100: Abschluss des 8. Bullenmarkt-Jahres in Reichweite

Im alternden Bullenmarkt in den USA wird die Luft zunehmend dünn. Werfen Sie einen Blick auf die totalen Renditen der amerikanischen Leitindizes von 2009-2016 - credit to Pension Partners:

Quelle: pensionpartners.com

Rohstoff- und Minenbranche: Der Wochenrückblick von Haywood

Werfen Sie einen Blick in den informativen Wochenrückblick von Haywood:

The iron ore rally continued this week, with the price of 62% iron fines reaching passing the $80 per tonne level for the second time in 3 weeks after briefly passing the $80 level in mid-November. Rebar prices have also soared, rising from $340 per tonne in mid-October to $480 per tonne on Friday. The rally has been largely attributed to strong infrastructure investment in China, as well as the country’s slowdown in supply growth, following Beijing’s decision to close 100 – 150 million tonnes of steel capacity through the end of the decade to increase profitability of remaining producers and tackle pollution.

The Weekly Dig - December 9, 2016

Iron Ore Prices Continue to Surge

Highlights:

The election victory by Donald Trump also provided further momentum after the President-elect highlighted increased infrastructure spend in the U.S. as a key component of his election campaign. Equity indices have also risen significantly, with both the Dow Jones Industrial Average and S&P 500 Index reaching historic highs; the Dow broke through the 19,500 level (after passing the 19,000 level on November 23). The surge in base metals was a little more subdued this week; copper, lead and zinc rose 1%, 2.3% and 1.6% respectively, while nickel was unchanged for the.

Meanwhile, the price of gold fell below the $1,160 level on Friday for the first time since February, with investors preparing for the Federal Reserve’s rate decision next week where a rate rise is assumed to be almost a certainty. Silver (up 1%), platinum (down 1.6%) and palladium (down 1.3%) also fell, finishing at $16.82, $913 and $733 per ounce respectively. WTI Crude prices pulled back this week after its 10% last week, finishing at $51 per barrel, while the UxC weekly spot price for uranium rose slightly to finish at $18.44 per pound.

Samstag, 10. Dezember 2016

Silberminen-Produktion: Aufteilung nach Metallherkunft

Nach wie vor kommen mehr als 2/3 der Silberminen-Produktion nicht von primären Silberlagerstätten, sondern werden als Beiprodukte in Basismetall- und Goldminen gefördert:

Quelle: GFMS, Thomas Reuters

Freitag, 9. Dezember 2016

China: Physische Gold-Nachfrage bleibt stark

Hierzu ein Blick auf die wöchentlichen Gold-Auslieferungen an der Goldbörse in Shanghai:

Quelle: goldchartsrus.com

Donnerstag, 8. Dezember 2016

Gold- & Silberminen, GDXJ: Fundamental-Kennziffern im 3. Quartal 2016

Informative Übersicht über die Q3-Entwicklung von ein paar ausgewählten, fundamentalen und operativen Kennziffern bei den kleinen bis mittelgroßen Gold- und Silberproduzenten im GDXJ - credit to ZealLLC:

Quelle: zealllc.com

Quelle: zealllc.com

Labels:

Alamos Gold,

B2Gold,

Centerra Gold,

Endeavour Mining,

Fundamentals,

GDXJ,

Goldminen,

Goldproduzenten,

IAMGOLD,

Junior-Mining,

Pretium Resources,

Silberminen,

Silberproduzenten,

Silver Standard Resources

Hausse setzt sich fort: Eisenerz markiert neues Mehrjahreshoch

Die Rally bei den Basis-Rohstoffen geht in die nächste Runde. Beim Eisenerzpreis wurde nun die markante Marke von 80 USD pro Tonne zurückerobert. Die Kassen bei BHP, Rio Tinto und Co. klingeln:

Iron ore price surges to 27-month high

The import price of 62% Fe content ore at the port of Tianjin raced 4.8% higher to $82.40 per dry metric tonne on Wednesday..

Link: http://www.mining.com/iron-ore-price-surges-27-month-high/

Iron ore price surges to 27-month high

The import price of 62% Fe content ore at the port of Tianjin raced 4.8% higher to $82.40 per dry metric tonne on Wednesday..

Link: http://www.mining.com/iron-ore-price-surges-27-month-high/

Quelle: mining.com

Gold- & Silberminen, GDX: Fundamental-Kennziffern im 3. Quartal 2016

Informative Übersicht über die Q3-Entwicklung einiger fundamentalen und operativen Kennziffern bei den großen Gold- und Silberproduzenten im GDX - credit to ZealLLC:

Quelle: zealllc.com

Quelle: zealllc.com

Labels:

Agnico Eagle Mines,

AngloGold,

Barrick Gold,

First Majestic Silver,

Franco-Nevada,

Fundamentals,

GDX,

Goldcorp,

Goldminen,

Goldproduzenten,

Newmont Mining,

Randgold Resources,

Silberminen,

Silver Wheaton

Mittwoch, 7. Dezember 2016

Aktienanalyse: Mining Stock Of The Week - Freeport McMoRan Inc.

Credit to Florian Grummes @ Seeking Alpha:

Mining Stock Of The Week - Freeport McMoRan Inc.

Summary:

In this weekly update I am going to present interesting opportunities in the commodity and precious metals sector. Today I am going to take a look at Freeport-McMoRan Inc. (NYSE:FCX)..

Link: http://seekingalpha.com/article/4028585-mining-stock-week-freeport-mcmoran-inc

Mining Stock Of The Week - Freeport McMoRan Inc.

Summary:

- New 52-week highs in November 2016.

- Mr. Icahn´s pressure is making Freeport a better company step by step.

- Taking some gains off the table or a tight stop makes sense.

In this weekly update I am going to present interesting opportunities in the commodity and precious metals sector. Today I am going to take a look at Freeport-McMoRan Inc. (NYSE:FCX)..

Link: http://seekingalpha.com/article/4028585-mining-stock-week-freeport-mcmoran-inc

Quelle: Midas Touch

Chinesisch-koreanische Investoren-Gruppe plant Gigafabrik für Lithium-Ionen-Batterien in Chile

Sehr spannende News und Entwicklungen im Lithium-Sektor in Chile:

Chinese-Korean group to build $2 billion lithium batteries plant in Chile

Chinese and Korean investors are said to be in advanced talks with the Chilean government to open up a $2 billion mega-lithium batteries plant in the country’s north, known for its vast salt flats under which experts say there is enough of the commodity to supply the world for decades..

Chinese-Korean group to build $2 billion lithium batteries plant in Chile

Chinese and Korean investors are said to be in advanced talks with the Chilean government to open up a $2 billion mega-lithium batteries plant in the country’s north, known for its vast salt flats under which experts say there is enough of the commodity to supply the world for decades..

Link: http://www.mining.com/chinese-korean-group-to-build-2-billion-lithium-batteries-plant-in-chile/

Chile contains half of the world’s most “economically extractable” reserves of lithium. (Image courtesy of University of Chile)

Richtungsweisendes Rebranding: Brazil Resources ändert Namen in GoldMining

Die ehemalige Junior-Firma Brazil Resources verkündet heute den Abschluss der Namensänderung in GoldMining. Im Hinblick auf die Lokalisierung der Hauptprojekte in Alaska, Kolumbien und Brasilien ist dieser Schritt mehr als sinnvoll und wurde schon länger erwartet. Zusätzlich wird das Ticker-Symbol an der kanadischen Börse TSX-Venture in "GOLD" geändert, was seinen Reiz hat. Zum ersten Mal in der kanadischen Börsenhistorie wurde dieses Symbol vergeben.

BRAZIL RESOURCES ANNOUNCES NAME CHANGE TO "GOLDMINING INC." AND NEW SYMBOLS "GOLD" IN CANADA AND "GLDLF" IN THE U.S.

FOR IMMEDIATE RELEASE

Highlights:

Vancouver, British Columbia – December 5, 2016 – Brazil Resources Inc. (the "Company" or "Brazil Resources") (TSX-V: BRI; OTCQX: BRIZF) is pleased to announce that its board of directors has approved a change of its name to "GoldMining Inc.", effective December 6, 2016, in order to better reflect its existing business. The Company also announces that it will concurrently complete a continuation (the "Continuation") under the Canada Business Corporations Act (the "CBCA").

Chairman of the Board, Amir Adnani, stated: "We are pleased to change the name of the Company to GoldMining Inc. to better reflect our diversified project portfolio and strategy to build a leading gold acquisition and development company throughout the Americas. With more than $21 million cash on hand – and now, a name that better reflects our Company's objectives – we plan to continue our exceptional growth with additional low-cost acquisitions of high quality gold projects, to build value throughout this period of a weak gold price environment."

The Company's common shares are expected to commence trading on the TSX Venture Exchange (the "TSX-V") under the new symbol "GOLD" and on the OTCQX International market (the "OTCQX") under the new symbol "GLDLF" on December 7, 2016. The Company expects that on the same date its listed warrants will commence trading on the TSX-V under the new symbol "GOLD.WT" and on the OTCQX under the new symbol "GOLWF".

In connection with the Continuation, the Company will adopt new Articles and By-Laws under the CBCA, copies of which are available under the Company's profile at www.sedar.com . The new By-Laws include, among other things, advance notice provisions whereby a shareholder seeking to nominate a candidate for a board seat must provide timely notice in proper form to the Company in advance of meetings of shareholders where directors are to be elected.

The Continuation, including the adoption of new Articles and By-Laws, and related matters were approved by shareholders of the Company at its annual general and special meeting held on November 23, 2016.

The CUSIP numbers assigned to the Company's common shares and listed warrants under its new name will be 38149E101 and 38149E119, respectively. No action will be required by existing shareholders or holders of warrants with respect to the name change or the Continuation. Certificates representing common shares and warrants of Brazil Resources will not be affected by the name change or the Continuation and will not need to be exchanged. The Company encourages any shareholder or warrantholder concerns in this regard to be directed to such person's broker or agent.

About GoldMining Inc./Brazil Resources Inc.

The Company is a public mineral exploration company with a focus on the acquisition, exploration and development of projects in Colombia, United States, Brazil, Canada and other regions of the Americas. Brazil Resources is advancing its Titiribi Gold-Copper Project in Colombia, its Whistler Gold-Copper Project in central Alaska, United States, its Cachoeira and São Jorge Gold Projects in northeastern Brazil and its Rea Uranium Project in the western Athabasca Basin in northeast Alberta, Canada.

Quelle: http://goldmining.com/_resources/news/nr_20161205.pdf

Quote:

Brazil Resources verbessert solide Finanzlage, Rodman & Renshaw erhöht Kursziel

Die Analysten von Rodman & Renshaw sehen weiterhin großes Performance-Potential bei Gold- & Uran-Junior Brazil Resources (V.BRI). Nach Abschluss der letzten Projekt-Akquisition, welche die Ressourcen-Basis auf über 22 Mio. Unzen Gold-Äquivalent erneut massiv erhöht hat, hat Brazil die starke Entwicklung des Aktienkurses für eine neue Kapitalmaßnahme ausgenutzt..

BRAZIL RESOURCES ANNOUNCES NAME CHANGE TO "GOLDMINING INC." AND NEW SYMBOLS "GOLD" IN CANADA AND "GLDLF" IN THE U.S.

FOR IMMEDIATE RELEASE

Highlights:

- Name change to "GoldMining Inc."

- Common shares to trade under new symbol "GOLD" on the TSX-V and "GLDLF" on the OTCQX

- With over $21 million cash on hand and no debt, the Company will aggressively execute its business plan to acquire and advance top-tier gold assets in the current depressed gold market environment

Chairman of the Board, Amir Adnani, stated: "We are pleased to change the name of the Company to GoldMining Inc. to better reflect our diversified project portfolio and strategy to build a leading gold acquisition and development company throughout the Americas. With more than $21 million cash on hand – and now, a name that better reflects our Company's objectives – we plan to continue our exceptional growth with additional low-cost acquisitions of high quality gold projects, to build value throughout this period of a weak gold price environment."

The Company's common shares are expected to commence trading on the TSX Venture Exchange (the "TSX-V") under the new symbol "GOLD" and on the OTCQX International market (the "OTCQX") under the new symbol "GLDLF" on December 7, 2016. The Company expects that on the same date its listed warrants will commence trading on the TSX-V under the new symbol "GOLD.WT" and on the OTCQX under the new symbol "GOLWF".

In connection with the Continuation, the Company will adopt new Articles and By-Laws under the CBCA, copies of which are available under the Company's profile at www.sedar.com . The new By-Laws include, among other things, advance notice provisions whereby a shareholder seeking to nominate a candidate for a board seat must provide timely notice in proper form to the Company in advance of meetings of shareholders where directors are to be elected.

The Continuation, including the adoption of new Articles and By-Laws, and related matters were approved by shareholders of the Company at its annual general and special meeting held on November 23, 2016.

The CUSIP numbers assigned to the Company's common shares and listed warrants under its new name will be 38149E101 and 38149E119, respectively. No action will be required by existing shareholders or holders of warrants with respect to the name change or the Continuation. Certificates representing common shares and warrants of Brazil Resources will not be affected by the name change or the Continuation and will not need to be exchanged. The Company encourages any shareholder or warrantholder concerns in this regard to be directed to such person's broker or agent.

About GoldMining Inc./Brazil Resources Inc.

The Company is a public mineral exploration company with a focus on the acquisition, exploration and development of projects in Colombia, United States, Brazil, Canada and other regions of the Americas. Brazil Resources is advancing its Titiribi Gold-Copper Project in Colombia, its Whistler Gold-Copper Project in central Alaska, United States, its Cachoeira and São Jorge Gold Projects in northeastern Brazil and its Rea Uranium Project in the western Athabasca Basin in northeast Alberta, Canada.

Quelle: http://goldmining.com/_resources/news/nr_20161205.pdf

Quote:

Brazil Resources verbessert solide Finanzlage, Rodman & Renshaw erhöht Kursziel

Die Analysten von Rodman & Renshaw sehen weiterhin großes Performance-Potential bei Gold- & Uran-Junior Brazil Resources (V.BRI). Nach Abschluss der letzten Projekt-Akquisition, welche die Ressourcen-Basis auf über 22 Mio. Unzen Gold-Äquivalent erneut massiv erhöht hat, hat Brazil die starke Entwicklung des Aktienkurses für eine neue Kapitalmaßnahme ausgenutzt..

Montag, 5. Dezember 2016

OPEC: Öl-Produktion markiert neues Rekordhoch

Während der Brent-Ölpreis im Freudentaumel nach der OPEC-Entscheidung heute auf ein neues Jahreshoch steigt, markiert die Förderquote der OPEC-Staaten ein neues Allzeithoch. Nicht die erste interessante Entwicklung am heutigen Handelstag:

OPEC Oil Production Hits New All Time High As Brent Surges To 16 Month High

The greatest trick OPEC ever pulled was convincing the world to buy oil even as production kept rising to new all time highs. Case in point, just out from Reuters:

OPEC Oil Production Hits New All Time High As Brent Surges To 16 Month High

The greatest trick OPEC ever pulled was convincing the world to buy oil even as production kept rising to new all time highs. Case in point, just out from Reuters:

- OPEC NOVEMBER OIL OUTPUT RISES 370,000 BPD MONTH/MONTH TO 34.19 MILLION BPD, HIGHEST IN RECENT HISTORY - REUTERS SURVEY

- SAUDI SUPPLY EDGES DOWN ON REFINERY MAINTENANCE AND REDUCED DIRECT CRUDE BURNING - REUTERS SURVEY

- OPEC OUTPUT RISE LED BY ANGOLA; NIGERIA, LIBYA AND IRAQ ALSO PUMP MORE

Quelle: zerohedge.com

Mega-Trend: Elektroautoverkäufe vor exponentiellem Wachstum

In 2015 wurden weltweit 1,2 Mio. Elektroautos verkauft. Nach zahlreichen Prognosen inkl. einem neuen Research-Bericht der IEA könnten im Jahr 2020 mehr als 15 Mal so viele EVs auf den Markt kommen. Das exponentielle Wachstum soll am stärksten von China und Indien getrieben werden..

Quelle: IEA

Freitag, 2. Dezember 2016

Junior-Gold- und Kupferproduzent K92 Mining: Positive Analysten-Kommentare nach Projektbesichtigung

Hierzu ein aktueller Bericht auf BNN:

K92 Mining impresses on first analyst tour of Kainantu

It didn’t take long after the first analyst tour of K92 Mining’s Kainantu Project in Papua New Guinea for bullish comments to start rolling in on this gold-copper asset that K92 acquired from Barrick Gold in 2015.

Production Fast Track with Massive Exploration Potential was the title of the Nov. 22, 2016 report issued by Clarus Securities analyst Nana Sangmuah after he spent time onsite in mid-November, alongside of other industry professionals from GMP Securities, Haywood Securities, and Macquarie. The site tour was hosted by K92 chief operating officer and director, John Lewins, and included visits to the underground operations, the processing facilities and surface infrastructure, and the large exploration tenements hosting multiple high priority exploration targets.

Further highlighting the upside, this post site visit report from Clarus notes, “We estimate a production growth rate of 200 per cent for KNT from 2017 to 2019, ahead of growth rate of peers averaging 21 per cent. Despite its compelling growth rate, KNT trades at a 0.3x P/NAV multiple, a ~60 per cent discount to junior producer peers trading at an average of 0.8x NAV.”

Haywood analyst Mick Carew commented in his initial post site visit report published on Nov. 23, 2016, “While the restart of mining at Irumafimpa represents a clear milestone for the Company, we see the medium- and long-term potential of the Kainantu project as particularly significant. With a recent PEA for the adjacent Kora deposit delivering a robust pre-tax NPV (five per cent) of US $415 million (US $386 million using an eight per cent discount rate) and an IRR of 113 per cent based on a 400,000 tpa operation, the current resource base at both Kora and Eutompi could be expanded.”

The past two months have been particularly busy for K92, with the company having commenced production from the Irumafimpa Deposit and then following it up by announcing the results of a PEA at the Kora Deposit, which is being targeted as the second deposit coming online. These two big fundamental achievements were recently described as the definition of a true “double-header," given that they concurrently occurred. With the restart commenced and given the company is providing clear guidance as to how it plans to dramatically grow production, K92’s recent share price represents not only a big discount to their peer group in terms of where the company is valued as a ratio of net asset value, but this is also combined with a much faster rate of production growth targeted.

K92 president Bryan Slusarchuk states, “The technical team onsite has done a great job getting production started on schedule and concurrently completing the PEA, which gives investors a clear growth path. The current discount to peer group valuation ought to appeal to deep value investors, while the growth rate targeted should appeal to investors seeking growth. With the project in great shape on the ground, we are now looking to expand the company’s profile as to make sure more and more investors follow us as the business plan is executed. While the project hosts high grade gold, many people are also starting to realize that Kora has a very strong copper component to it and that is also attracting attention given copper’s recent move.”

K92 is currently in the process of ramping up production towards steady state and also has two drill rigs onsite, one conducting grade control drilling, and one geared towards expansion and exploration drilling. The company has a strong group of institutional shareholders and trades in Canada under the symbol KNT (TSX.V), in the U.S. (KNTNF) and in Germany (92K).

Link: http://www.bnn.ca/k92-mining-impresses-on-first-analyst-tour-of-kainantu-1.620069

K92 Mining impresses on first analyst tour of Kainantu

It didn’t take long after the first analyst tour of K92 Mining’s Kainantu Project in Papua New Guinea for bullish comments to start rolling in on this gold-copper asset that K92 acquired from Barrick Gold in 2015.

Production Fast Track with Massive Exploration Potential was the title of the Nov. 22, 2016 report issued by Clarus Securities analyst Nana Sangmuah after he spent time onsite in mid-November, alongside of other industry professionals from GMP Securities, Haywood Securities, and Macquarie. The site tour was hosted by K92 chief operating officer and director, John Lewins, and included visits to the underground operations, the processing facilities and surface infrastructure, and the large exploration tenements hosting multiple high priority exploration targets.

Further highlighting the upside, this post site visit report from Clarus notes, “We estimate a production growth rate of 200 per cent for KNT from 2017 to 2019, ahead of growth rate of peers averaging 21 per cent. Despite its compelling growth rate, KNT trades at a 0.3x P/NAV multiple, a ~60 per cent discount to junior producer peers trading at an average of 0.8x NAV.”

Haywood analyst Mick Carew commented in his initial post site visit report published on Nov. 23, 2016, “While the restart of mining at Irumafimpa represents a clear milestone for the Company, we see the medium- and long-term potential of the Kainantu project as particularly significant. With a recent PEA for the adjacent Kora deposit delivering a robust pre-tax NPV (five per cent) of US $415 million (US $386 million using an eight per cent discount rate) and an IRR of 113 per cent based on a 400,000 tpa operation, the current resource base at both Kora and Eutompi could be expanded.”

The past two months have been particularly busy for K92, with the company having commenced production from the Irumafimpa Deposit and then following it up by announcing the results of a PEA at the Kora Deposit, which is being targeted as the second deposit coming online. These two big fundamental achievements were recently described as the definition of a true “double-header," given that they concurrently occurred. With the restart commenced and given the company is providing clear guidance as to how it plans to dramatically grow production, K92’s recent share price represents not only a big discount to their peer group in terms of where the company is valued as a ratio of net asset value, but this is also combined with a much faster rate of production growth targeted.

K92 president Bryan Slusarchuk states, “The technical team onsite has done a great job getting production started on schedule and concurrently completing the PEA, which gives investors a clear growth path. The current discount to peer group valuation ought to appeal to deep value investors, while the growth rate targeted should appeal to investors seeking growth. With the project in great shape on the ground, we are now looking to expand the company’s profile as to make sure more and more investors follow us as the business plan is executed. While the project hosts high grade gold, many people are also starting to realize that Kora has a very strong copper component to it and that is also attracting attention given copper’s recent move.”

K92 is currently in the process of ramping up production towards steady state and also has two drill rigs onsite, one conducting grade control drilling, and one geared towards expansion and exploration drilling. The company has a strong group of institutional shareholders and trades in Canada under the symbol KNT (TSX.V), in the U.S. (KNTNF) and in Germany (92K).

Link: http://www.bnn.ca/k92-mining-impresses-on-first-analyst-tour-of-kainantu-1.620069

Quelle: k92mining.com

Gold, Terminbörse: Volumen an der COMEX markiert neues Rekordhoch

In der US-Wahlwoche Anfang November erreichte das Volumen an der kontroversen Gold-Terminbörse COMEX ein neues Allzeithoch. Der Blick auf den spektakulären Langfrist-Chart:

Quelle: Gold Monitor

Donnerstag, 1. Dezember 2016

Großer Meilenstein: Continental Gold erhält die Umweltgenehmigung für das Weltklasse Buriticá Goldprojekt in Kolumbien

Nach einer jahrelangen Hängepartie, vielen Unsicherheiten und einer sehr großer Überzeugungsarbeit ist Continental Gold (TSX:CNL) am Ziel angekommen. Die kanadische Junior-Firma erhält die entscheidende Umweltgenehmigung für das Weltklasse Flaggschiffprojekt Buritcá. Ein großer Meilenstein für Continental - und die gesamte Goldminenbranche in Kolumbien.

Continental Gold Receives Environmental Permit for the Buritica Project

Toronto, Ontario, November 30, 2016 – Continental Gold Inc. (TSX:CNL; OTCQX:CGOOF) (“Continental Gold” or the “Company”) is pleased to announce the receipt of the environmental permit for the Company’s Buriticá project.

Resolution No. 01443, dated November 30, 2016, was issued by ANLA, the Colombian National Authority of Environmental Licenses, approving the Company’s application for an amendment to the Environmental License for the Buriticá project located in Antioquia, Colombia. The resolution authorizes Continental Gold to expand its current small-scale operating mine to a fully integrated mining and milling operation, as outlined in the Company’s Feasibility Study dated March 29, 2016. Specifically, the resolution allows Continental Gold to operate and construct all mining and milling-related facilities, including a processing plant up to a maximum of 3,200 tonnes per day. In addition, the resolution allows the Company to mine alluvial material required for construction during the pre-production and production phases of operations and requires the Company to follow strict and environmentally-conscious best practice protocols for the operation and closure of the mine.

Ari Sussman, CEO of Continental Gold, commented: “The completion of permitting for the Buriticá project is a strong testament to Colombia’s willingness to embrace responsible mining and its desire to reinvigorate the gold industry for a country that holds the title as the most prolific gold producer in Latin American history. We would like to thank the local communities, the Government of Antioquia and the National Colombian Government for their confidence in Continental Gold’s ability to deliver a robust environmentally-responsible mine that will yield significant benefits for all stakeholders.”

“The modification of the Environmental License, granted by ANLA, reflects Continental Gold’s commitment to building a modern mine with strong operational, environmental and social standards, while generating well-being and development for the communities of Buriticá, the region of Western Antioquia and Colombia,” stated Mateo Restrepo, President of Continental Gold..

Continental Gold Receives Environmental Permit for the Buritica Project

Toronto, Ontario, November 30, 2016 – Continental Gold Inc. (TSX:CNL; OTCQX:CGOOF) (“Continental Gold” or the “Company”) is pleased to announce the receipt of the environmental permit for the Company’s Buriticá project.

Resolution No. 01443, dated November 30, 2016, was issued by ANLA, the Colombian National Authority of Environmental Licenses, approving the Company’s application for an amendment to the Environmental License for the Buriticá project located in Antioquia, Colombia. The resolution authorizes Continental Gold to expand its current small-scale operating mine to a fully integrated mining and milling operation, as outlined in the Company’s Feasibility Study dated March 29, 2016. Specifically, the resolution allows Continental Gold to operate and construct all mining and milling-related facilities, including a processing plant up to a maximum of 3,200 tonnes per day. In addition, the resolution allows the Company to mine alluvial material required for construction during the pre-production and production phases of operations and requires the Company to follow strict and environmentally-conscious best practice protocols for the operation and closure of the mine.

Ari Sussman, CEO of Continental Gold, commented: “The completion of permitting for the Buriticá project is a strong testament to Colombia’s willingness to embrace responsible mining and its desire to reinvigorate the gold industry for a country that holds the title as the most prolific gold producer in Latin American history. We would like to thank the local communities, the Government of Antioquia and the National Colombian Government for their confidence in Continental Gold’s ability to deliver a robust environmentally-responsible mine that will yield significant benefits for all stakeholders.”

“The modification of the Environmental License, granted by ANLA, reflects Continental Gold’s commitment to building a modern mine with strong operational, environmental and social standards, while generating well-being and development for the communities of Buriticá, the region of Western Antioquia and Colombia,” stated Mateo Restrepo, President of Continental Gold..

Mittwoch, 30. November 2016

A November To Remember

Der November 2016 wird an den Kapitalmärkten sicher in die Geschichtsbücher eingehen:

November To Remember - Unprecedented Month In Markets Ends Weak

Link: http://www.zerohedge.com/news/2016-11-30/november-remember-unprecedented-month-markets-ends-weak

November To Remember - Unprecedented Month In Markets Ends Weak

- Russell 2000 +11% - best since October 2011

- Dow +5.5% - best since March 2016

- US Financial Stocks +14% - best since April 2009

- Goldman Sachs +23% - best since December 2000

- US Energy Stocks +9% - best since October 2015

- FANG Stocks -6.2% - worst since March 2014

- "Most Shorted" Stocks +11% - best since September 2010

- US Treasury Bonds (TLT) -8% - worst since January 2009

- Treasury 'VIX' +18% - worst since January 2015

- Emerging Market Bonds -4.7% - worst since May 2013

- Risk-Parity Funds -3.1% - worst since December 2015

- USD Index +3.8% - best since September 2014

- Mexican Peso -8.6% - worst since May 2012

- Japanese Yen -8.9% - worst since August 1995

- Chinese Yuan -2% - worst since December 2015

- Emerging Market FX -4.5% - worst since May 2012

- Gold -8% - worst since June 2013

- Silver -8% - worst since May 2016

- Copper +19% - best since March 2009

- BIS "Fear' Index (Global Basis Swap) -3bps - worst since Feb 2016

Link: http://www.zerohedge.com/news/2016-11-30/november-remember-unprecedented-month-markets-ends-weak

Quelle: zerohedge.com

Labels:

Aktien,

Anleihen,

Banken,

Börse,

Devisenmarkt,

Emerging Markets,

Energiebranche,

FED,

Gold,

Goldman Sachs,

Kapitalmarkt,

Kupfer,

Rohstoffe,

Silber,

Trump,

USA,

Währungen

Dienstag, 29. November 2016

Wealth Minerals: CEO Henk Van Alphen im Interview bei BBC über die große Bedeutung von Chile im Lithium-Markt

Wealth Minerals' (V.WML) CEO Henk Van Alphen ergattert erneut einen begehrten Medien-Platz bei Gigant BBC. Folgend sehen Sie das Video-Interview, welches gestern in London aufgezeichnet wurde:

Quelle: Wealth Minerals

Labels:

Ausblick,

Batteriemarkt,

BBC,

Chile,

Interview,

Junior-Mining,

Lithium,

Lithiummarkt,

Medien,

Minenaktien,

Technologie,

Wealth Minerals,

Zukunft

Montag, 28. November 2016

TerraX Minerals: Erfolgreiches Explorationsjahr auf dem Yellowknife City Gold-Projekt in Kanada

Die Junior-Firma TerraX Minerals (V.TXR) konnte in diesem Jahr signifikante Explorationsfortschritte auf dem Hauptprojekt Yellowknife City Gold verzeichnen. Im kommenden Jahr wird die erste, bedeutende Ressourcen-Schätzung erwartet.

Bis Ende des Jahres visiert TerraX die Publikation von 24 weiteren Bohrlöchern von der Sommerphase des 27.000 Bohrmeter starken Explorationsprogramms an. Die Winterphase des Drilling-Programms wird Anfang Januar 2017 starten. Hierzu ein informatives Video-Update:

Quote:

Gold-Explorer TerraX Minerals schließt Sommer-Bohrprogramm ab und verstärkt Management-Team

Die kanadische Junior-Firma TerraX Minerals (V.TXR) hat die Sommerphase des 27.000 Bohrmeter starken Explorationsprogramms auf dem Hauptprojekt Yellowknife City Gold erfolgreich abgeschlossen (NR)..

Bis Ende des Jahres visiert TerraX die Publikation von 24 weiteren Bohrlöchern von der Sommerphase des 27.000 Bohrmeter starken Explorationsprogramms an. Die Winterphase des Drilling-Programms wird Anfang Januar 2017 starten. Hierzu ein informatives Video-Update:

Quelle: stockcharts.com

Quote:

Gold-Explorer TerraX Minerals schließt Sommer-Bohrprogramm ab und verstärkt Management-Team

Die kanadische Junior-Firma TerraX Minerals (V.TXR) hat die Sommerphase des 27.000 Bohrmeter starken Explorationsprogramms auf dem Hauptprojekt Yellowknife City Gold erfolgreich abgeschlossen (NR)..

Link: http://rohstoffaktien.blogspot.de/2016/10/gold-explorer-terrax-minerals-schliet.html

Quote #2:

Wachsende Gold-Discovery in Kanada: TerraX Minerals steht vor einem heißen Herbst

Der erfolgreiche Gold-Explorer TerraX Minerals (V.TXR) ist aktuell auf Roadshow in Europa und ich hatte die Möglichkeit den CEO Joe Campbell und CFO Stuart Rogers zu sprechen..

Link: http://rohstoffaktien.blogspot.co.at/2016/09/wachsende-gold-discovery-in-kanada.html

Wachsende Gold-Discovery in Kanada: TerraX Minerals steht vor einem heißen Herbst

Der erfolgreiche Gold-Explorer TerraX Minerals (V.TXR) ist aktuell auf Roadshow in Europa und ich hatte die Möglichkeit den CEO Joe Campbell und CFO Stuart Rogers zu sprechen..

Link: http://rohstoffaktien.blogspot.co.at/2016/09/wachsende-gold-discovery-in-kanada.html

Labels:

Discovery,

Erfolg,

Exploration,

Fahrplan,

Finanzierung,

Fortschritt,

Gold,

Goldaktien,

Goldminen,

high-grade,

Investoren,

Junior-Mining,

Kanada,

Kapital,

Osisko Gold Royalties,

TerraX Minerals,

Yellowknife

Samstag, 26. November 2016

Gold, Terminmarkt: Extrem bärisches Sentiment bei den Optionstradern

Die Extrempositionierung bei den Optionstradern sollte beim gelben Metall einen kurzfristigen Boden ankündigen:

Quelle: zerohedge.com

Quelle: zerohedge.com

Freitag, 25. November 2016

Mittwoch, 23. November 2016

Dienstag, 22. November 2016

Video-Interview auf der internationalen Edelmetall- und Rohstoffmesse 2016 in München

Aufgenommen am 3. November:

"Jahresendrallye bei Kupfer und Uranium.."

"Jahresendrallye bei Kupfer und Uranium.."

Montag, 21. November 2016

Picture Of The Day: The 'United' States Of America (Without The Electoral College)

Sonntag, 20. November 2016

Hohe Investoren-Nachfrage: Neues Goldminen-ETF startet in Hongkong

Letzten Freitag wurde in der asiatischen Finanzmetropole ein neues Goldminen-ETF gestartet, das die hohe Nachfrage nach Goldminen-Investmentprodukten stillen soll:

FIRST GOLD MINERS ETF LAUNCHES IN HONG KONG

A gold miners exchange traded fund (ETF), a first in Hong Kong, was launched on the Hong Kong Exchange & Clearing (HKEX) today, Friday November 18.

The ETF – known as “XIE Shares FTSE Gold Miners ETF” – invests in a basket of physical equities and replicates the FTSE Gold Mines Net Tax Index, which currently represents 35 global gold mining companies that produce a minimum of 300,000 ounces of gold per year. Some of the countries represented in the ETF include Canada, US, South Africa, and Australia.

The Gold Miners ETF meets increasing investor demand for gold investing in light of a loss in confidence in paper money, caused by the increasing debt of developed countries, said Enhanced Investment Products (EIP), whose ETF business XIE Shares launched the ETF.

This debt, and recent political events such as Brexit and the US elections, point to more volatility and uncertainty in financial markets, and gold provides a hedge against inflation or deflation and is a store of value, EIP said in its statement.

“This new product…will enable retail and institutional investors to capitalise on gold price fluctuations through the ownership of gold mining stocks, which tend to go up and down more than the price of gold, given the size of their gold deposits relative to their market capitalisation. This year, gold mining stocks are outperforming physical gold by approximately 50%,” EIP’s ceo Tobias Bland said.

EIP is a Hong Kong-based investment management firm which was established in 2002. Brokerage and investment group CLSA acquired 49% of the XIE Shares Hong Kong ETF platform in 2014.

Net inflows into exchange traded products (ETP) have helped drive a sharp increase in gold investment demand this year, according to the World Gold Council (WGC).

Total gold investment demand rose 44% year-on-year to 336 tonnes in the third quarter of this year, with ETP inflows accounting for 146 tonnes as investors continued to build up their strategic allocations to gold, the WGC said in its report in November.

The spot gold price has risen around 30% since the beginning of this year to reach as high as $1,375.25 in July. The price has since pared to $1,205 per oz recently on Friday, but is still higher than the low of $1,062.40 reached at the beginning of this year. - See more at:

FIRST GOLD MINERS ETF LAUNCHES IN HONG KONG

A gold miners exchange traded fund (ETF), a first in Hong Kong, was launched on the Hong Kong Exchange & Clearing (HKEX) today, Friday November 18.

The ETF – known as “XIE Shares FTSE Gold Miners ETF” – invests in a basket of physical equities and replicates the FTSE Gold Mines Net Tax Index, which currently represents 35 global gold mining companies that produce a minimum of 300,000 ounces of gold per year. Some of the countries represented in the ETF include Canada, US, South Africa, and Australia.

The Gold Miners ETF meets increasing investor demand for gold investing in light of a loss in confidence in paper money, caused by the increasing debt of developed countries, said Enhanced Investment Products (EIP), whose ETF business XIE Shares launched the ETF.

This debt, and recent political events such as Brexit and the US elections, point to more volatility and uncertainty in financial markets, and gold provides a hedge against inflation or deflation and is a store of value, EIP said in its statement.

“This new product…will enable retail and institutional investors to capitalise on gold price fluctuations through the ownership of gold mining stocks, which tend to go up and down more than the price of gold, given the size of their gold deposits relative to their market capitalisation. This year, gold mining stocks are outperforming physical gold by approximately 50%,” EIP’s ceo Tobias Bland said.

EIP is a Hong Kong-based investment management firm which was established in 2002. Brokerage and investment group CLSA acquired 49% of the XIE Shares Hong Kong ETF platform in 2014.

Net inflows into exchange traded products (ETP) have helped drive a sharp increase in gold investment demand this year, according to the World Gold Council (WGC).

Total gold investment demand rose 44% year-on-year to 336 tonnes in the third quarter of this year, with ETP inflows accounting for 146 tonnes as investors continued to build up their strategic allocations to gold, the WGC said in its report in November.

The spot gold price has risen around 30% since the beginning of this year to reach as high as $1,375.25 in July. The price has since pared to $1,205 per oz recently on Friday, but is still higher than the low of $1,062.40 reached at the beginning of this year. - See more at:

Gold, Big Picture: Entwicklung der ETF-Holdings vs. Goldpreis

Nach dem Wahlausgang in den USA fallen die Bestände in den wichtigsten Gold-ETFs deutlich zurück. Der Goldpreis verzeichnet die schlechteste zweiwöchige Performance seit Juni 2013. Im Gesamtbild liegen die ETF-Bestände aber weit über den Jahrestiefständen:

Quelle: zerohedge.com

Metals Investor Forum in Vancouver: Präsentation von Black Sea Copper & Gold's CEO Vince Sorace

Der ambitionierte CEO und Präsident der jungen Explorationsfirma Black Sea Copper & Gold (V.BLS) hielt letzte Woche einen informativen Vortrag auf dem Metals Investor Forum in Vancouver:

Quote:

Black Sea Copper & Gold startet Exploration auf Alankoy in der Türkei und nimmt Tookie Angus in den Vorstand auf

Gleich zwei positive Nachrichten gab es bei Juniorfirma Black Sea Copper & Gold (V.BLS) in den letzten Tagen.

Quote:

Black Sea Copper & Gold startet Exploration auf Alankoy in der Türkei und nimmt Tookie Angus in den Vorstand auf

Gleich zwei positive Nachrichten gab es bei Juniorfirma Black Sea Copper & Gold (V.BLS) in den letzten Tagen.

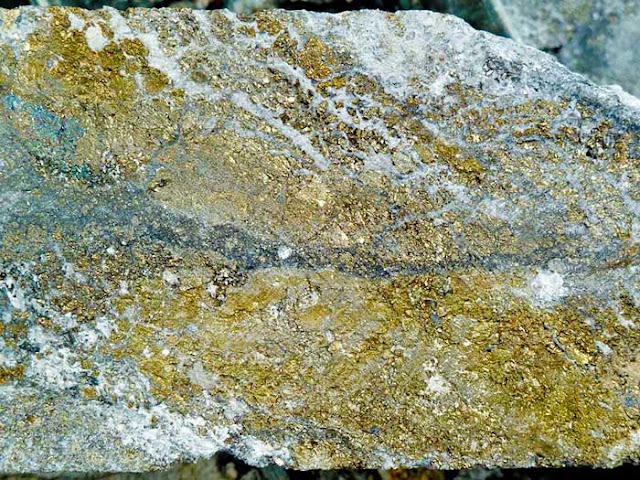

Zunächst beginnt Black Sea das 1. Explorationsprogramms auf dem Alankoy-Projekt in der Türkei (NR). Die aussichtsreichen Gold- und Kupferliegenschaften waren zuvor im Besitz von Eurasian Minerals. Black Sea wird eine intensive, geologische Kartierung vornehmen, Gesteinsproben entnehmen und geophysikalische Bodenuntersuchungen durchführen. Mit diesen gewöhnlichen Vorbereitungsprogrammen soll der Weg für ein zukünftiges Bohrprogramm gelegt werden.

Das Alankoy-Projekt befindet sich in einem aktiven Rohstoffbezirk. In der Nachbarschaft sind u.a. Alamos Gold und Pilot Gold / Teck Resources tätig.

Das Alankoy-Projekt befindet sich in einem aktiven Rohstoffbezirk. In der Nachbarschaft sind u.a. Alamos Gold und Pilot Gold / Teck Resources tätig.

Quelle: blacksea.ca

Außerdem verstärkt der Explorer sein Vorstandsteam mit einem sehr kompetenten und erfolgreichen Manager, der in der Rohstoffszene eine hohe Reputation besitzt. Black Sea gibt nämlich die Aufnahme von Tookie Angus bekannt (NR), der sich u.a. in Führungsrollen bei Nevsun, Ventana Gold (Übernahme durch AUX), First Quantum, Canico und Wildcat Silver (Arizona Mining) profilieren konnte.

Quote:

Black Sea Copper & Gold schließt Übernahme ab und startet an der TSX-Venture

Die neue Junior-Firma Black Sea Copper & Gold hat erfolgreich die Übernahmetransaktion von Alternative Earth Resources abgeschlossen. Seit ein paar Tagen ist die neue Aktie an der TSX-Venture unter dem Symbol "BLS" gelistet. Black Sea besitzt ein sehr erfahrenes Management-Team und hat sich ein umfassendes Portfolio an aussichtsreichen Kupfer- und Goldprojekten in Osteuropa gesichert..

Werfen Sie auch einen Blick in die informative, neue Firmen-Präsentation: https://blacksea.ca/assets/docs/presentations/bscg_presentation_oct-13-2016.pdf

Quelle: blacksea.ca

Quelle: blacksea.ca

Quote:

Black Sea Copper & Gold schließt Übernahme ab und startet an der TSX-Venture

Die neue Junior-Firma Black Sea Copper & Gold hat erfolgreich die Übernahmetransaktion von Alternative Earth Resources abgeschlossen. Seit ein paar Tagen ist die neue Aktie an der TSX-Venture unter dem Symbol "BLS" gelistet. Black Sea besitzt ein sehr erfahrenes Management-Team und hat sich ein umfassendes Portfolio an aussichtsreichen Kupfer- und Goldprojekten in Osteuropa gesichert..

Labels:

Alankoy,

Black Sea Copper & Gold,

Europa,

Exploration,

Gold,

Junior-Mining,

Kupfer,

M&A,

MIF,

Minen-Konferenz,

Minenaktien,

Präsentation,

Tookie Angus,

Transaktion,

TSX-Venture,

Türkei,

Vince Sorace

Freitag, 18. November 2016

Dollar-Index erreicht neues Jahreshoch, Euro verzeichnet historische Verlustserie

Der viel beachtete USD-Index brach in den letzten Tagen über die markante Marke von 100 aus (Momentaufnahme) und erreichte ein neues Mehrjahreshoch. Parallel steigen die Chancen einer Zinserhöhung in den USA im Dezember auf den höchsten Stand YTD. Währenddessen befinden sich Euro und Yen zum US-Dollar in einem historischen Fall. Hierzu zwei aufschlussreiche Charts:

Quelle: bloomberg.com

Quelle: bloomberg.com

Labels:

Charts,

Devisenmarkt,

Dollar,

Dollarindex,

DXY,

EUR,

EUR/USD,

Euro,

FED,

Geldpolitik,

Momentum,

Performance,

USD,

Währungen,

Yellen,

Yen,

Zinsen

Samstag, 29. Oktober 2016

Big Picture: Goldminen-ETF GDX vs. 200-Tageslinie

Nachdem sich die Goldminen (GDX) im Zuge der spektakulären Rally bis zu 60% von der 200-Tageslinie entfernt hatten, wurde diese außergewöhnliche Konstellation in der jüngsten Korrektur komplett abgebaut:

Quelle: iShares, SPDR, Vanguard, Van Eck, GDX

Labels:

Agnico Eagle Mines,

AngloGold,

Barrick Gold,

Charttechnik,

Franco-Nevada,

GDX,

Goldaktien,

Goldcorp,

Goldminen,

Goldproduzenten,

HUI,

Kinross Gold,

Newmont Mining,

Randgold Resources,

Royal Gold,

Yamana Gold

Profiteur der Yuan-Abwertung: Bitcoin-Preis zieht um 10% in einer Woche an

Der Bitcoin-Preis wird durch anhaltenden Kaufdruck aus China weiter befeuert und erreicht zuletzt ein 3-Monatshoch:

Quote:

Bitcoin Is Soaring: Up Over 10% In One Week On Chinese Buying Spree

Earlier this week, we pointed out that after tracking the recent drop in the Yuan (alternatively, rise in the dollar), bitcoin unexpectedly spiked breaking out of its recent rangebound trade and rising to three month highs following news that China had begun a regulatory crackdown on wealth-management products, which indicated that some of the illicit money parked in these shadow bank conduits, which collectively house just shy of $2 trillion in assets, will slowly drift out of the mainland using such capital outflow "proxies" as bitcoin..

Quelle: zerohedge.com

Quelle: zerohedge.com

Quelle: zerohedge.com

Quote:

Bitcoin Is Soaring: Up Over 10% In One Week On Chinese Buying Spree

Earlier this week, we pointed out that after tracking the recent drop in the Yuan (alternatively, rise in the dollar), bitcoin unexpectedly spiked breaking out of its recent rangebound trade and rising to three month highs following news that China had begun a regulatory crackdown on wealth-management products, which indicated that some of the illicit money parked in these shadow bank conduits, which collectively house just shy of $2 trillion in assets, will slowly drift out of the mainland using such capital outflow "proxies" as bitcoin..

Kupfer: Beste Handelswoche in 8 Monaten

Mit Gewinnen von über 5% präsentierte sich Dr. Copper letzte Woche besonders stark:

Quelle: zerohedge.com

Quelle: zerohedge.com

Eisenerz: Chinesen kaufen größtes Minenprojekt der Welt

Rio Tinto (RIO) zieht sich vom gigantischen Simandou Eisenerz-Projekt in Guinea zurück. Damit ist der Weg für den chinesischen Branchenriesen Chinalco frei, das größte Minenprojekt der Welt zu übernehmen:

Chinese buy world's largest mining project

World number two miner Rio Tinto is exiting the world's largest mining project, by selling its stake in Guinea's Simandou iron ore to partner Chinalco, potentially opening up a new path to development for the $20 billion project.

According to a statement by Melbourne-based Rio the deal is worth between $1.1 billion and $1.3 billion payable when Simandou starts commercial production and based on output. Rio says a final agreement could be inked within six months. In February this year Rio wrote down the value of Simandou by $1.1 billion, before deciding to shelve the project.

Rio owns 46.6% of Simandou south; Chinalco's stake is 41.3% and the Guinea government holds 7.5%. Earlier this month the World Bank's financing arm – the International Finance Corporation – sold its its 4.6% interest.With complete control, Beijing-based Chinalco may revive the stalled project with the backing of the Chinese government..

Chinese buy world's largest mining project

World number two miner Rio Tinto is exiting the world's largest mining project, by selling its stake in Guinea's Simandou iron ore to partner Chinalco, potentially opening up a new path to development for the $20 billion project.

According to a statement by Melbourne-based Rio the deal is worth between $1.1 billion and $1.3 billion payable when Simandou starts commercial production and based on output. Rio says a final agreement could be inked within six months. In February this year Rio wrote down the value of Simandou by $1.1 billion, before deciding to shelve the project.

Rio owns 46.6% of Simandou south; Chinalco's stake is 41.3% and the Guinea government holds 7.5%. Earlier this month the World Bank's financing arm – the International Finance Corporation – sold its its 4.6% interest.With complete control, Beijing-based Chinalco may revive the stalled project with the backing of the Chinese government..

Labels:

Afrika,

Branchengiganten,

China,

Chinalco,

Einfluss,

Eisenerz,

Eisenerzproduzenten,

Guinea,

Minenprojekt,

Rio Tinto,

Simandou,

World Bank Group

Rohstoff- und Minenbranche: Der Wochenrückblick von Haywood

Der Link zum lesenswerten Wochen-Report von Haywood.

The Weekly Dig - October 28, 2016

Mick Carew, PhD

and The Haywood Mining Team

Gold Price Volatility Continues as Rate Decision Looms

Highlights:

As the U.S. elections draws nearer and prospects intensify, the price of gold has experienced significant volatility over the last few weeks. The first week of October saw the yellow metal push through the $1,300 per ounce level, briefly testing the $1,250 per ounce level (falling to $1,247 per ounce during intra-day trading on October 14). This last week has seen the gold price fluctuate between $1,260 and $1,275 per ounce, hitting the $1,284 per ounce level on Friday before settling at $1,276 per ounce at close.

While the U.S. election campaign remains controversial, particularly in regards to Donald Trump’s candidacy, the email scandal continues to haunt Hillary Clinton; on Friday news broke that the FBI would investigate additional emails that had surfaced relating to Hillary Clinton's use of a private email system that allegedly contained classified information. In turn, any event that potentially swings the electorate in Trump’s favour continues to be positive for gold as the republican candidate’s controversial policies and personal life divides the nation.

Meanwhile, the other precious metals varied in terms of performance for the week; platinum rose 4.5% to finish at $981 per ounce while palladium retreated 0.6%, while silver rose only slightly to finish at $620 and $17.77 per ounce respectively. Base metals prices jumped this week, with Copper and nickel prices finishing 4.5% and 4.6% higher to finish at $2.19 and $4.72 per pound respectively, while lead and zinc also gained ground. After rising above the $50 per barrel mark in recent weeks, WTI crude fell back to $49 per barrel this week, while the UxC weekly spot price for uranium remained below the $20 per pound level to finish at $19.59 per pound.

Quelle: stockcharts.com

Freitag, 28. Oktober 2016

Big Picture: Goldpreis vs. kumulierte Bilanzsummen der wichtigsten Zentralbanken

Die aggregierte Bilanzsumme der FED, EZB, SNB, PBoC und BoJ markiert in 2016 ein neues Rekordhoch und steht jetzt bei über 17 Billionen USD:

Quelle: In Gold We Trust, incrementum.li

Mexiko: Edelmetalle bleiben die dominante Kraft in der Minenindustrie

In der mexikanischen Minenindustrie kommen Gold und Silber in 2016 auf einen Anteil (Metallwert) von rund 48%. Damit behalten die Edelmetalle ihre dominante Position:

Ein informativer Überblick über die gegenwärtig wichtigsten Minenprojekte:

Quelle: BMI

Ein informativer Überblick über die gegenwärtig wichtigsten Minenprojekte:

Quelle: BMI

Abonnieren

Posts (Atom)